By Ben van der Meer

Staff Writer, Sacramento Business Journal

One of the most aggressive local land developers and home lot buyers of recent years has made its biggest purchase yet, in the form of stalled master plan Placer Ranch.

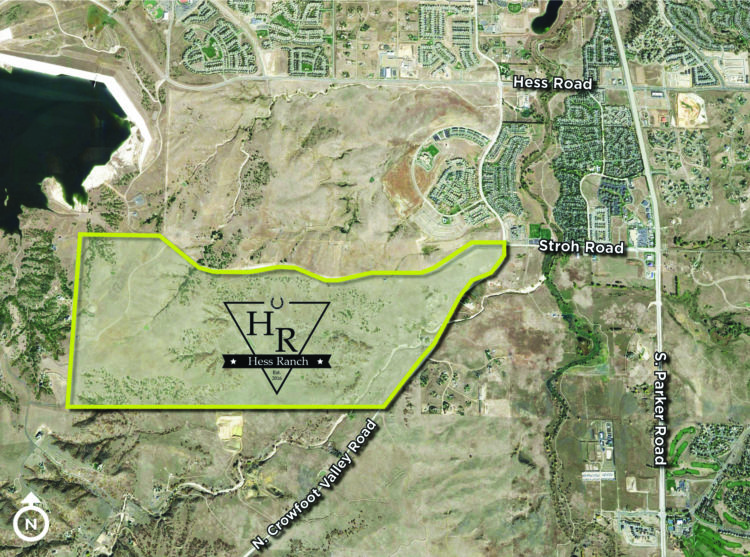

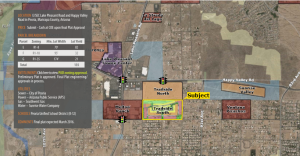

Roseville-based Taylor Builders Inc. paid $100 million to acquire the 2,213-acre project and its associated entitlements in unincorporated Placer County between Roseville and Lincoln. JEN Partners LLC, a New York-based real estate private equity fund, is Taylor Builders' partner in the acquisition.

"We just feel like it's the best master plan in the region that could be shovel ready in 12 months," said Taylor Builders President Clifton Taylor. "We're really appreciative of the opportunity the seller gave us to step into the deal."

By this time next year, he said, site work for Placer Ranch should be underway, with the first lot development for about 600 homes in early 2023. "You know us. We don't sleep on the plan," he said.

Fully entitled, Placer Ranch is planned to have about 5,600 homes, 5 million square feet of commercial space and 334 acres of park and recreation facilities.

But its most unique component is 300 acres in its center planned as a future Placer County campus for California State University Sacramento. Master planning and environmental work on that project is planned to be completed next year, though timing for campus development is unclear.

Sacramento State, which received the land as a donation last month from Placer Ranch's previous owner, projects the campus could support up to 25,000 students. The property will also have a Sierra College transfer center that would serve another 5,000 students.

Taylor said he believes Taylor Builders will develop Placer Ranch largely as its entitlements call for, but in phases, so build-out will likely take decades.

In a news release announcing the deal, Placer Ranch Inc. President Holly Tiche said the sellers were confident in Taylor Builders' ability to deliver the project.

"Today's announcement is the next logical step following our donation last month of 300 acres to Sacramento State so that the Placer Center campus can be developed," she said. "Those of us who've been involved in this effort for a long time are looking forward to seeing this incredible community come to life."

The estate of Los Angeles developer Eli Broad, who originally proposed Placer Ranch two decades ago, owned the land before selling to Taylor Builders.

Though a Sac State campus emerged as a possible anchor piece for Placer Ranch early on, the project never moved beyond entitlement review in succeeding years. Broad cited estate planning in putting the project on hold in 2008, as housing development across the board nearly stopped during the Great Recession.

Five years later, Roseville-based Westpark Communities announced it was taking over and restarting the project, but turned the site back over to Broad two years later, saying it didn't make financial sense. County planners decided to continue entitlement review to make the project more attractive to another developer.

Because Taylor Builders is developing nearby communities such as Fiddyment Ranch in Roseville and Whitney Ranch in Rocklin, Taylor said, he's confident the firm can make Placer Ranch work.

"We're developing on its south boundary, and we know the infrastructure requirements," he said. "We feel like we have a unique lens to understand the deal."

Having a driver like a university campus at the middle of the project is also a rare advantage, Taylor added.

With two Taylor Builders projects in Placer County also nearing build-out, he said, there's a need to line up another project in the Highway 65 area. Placer Ranch would also have 3 miles of the proposed Placer Parkway project crossing through it.

Because it's at an early stage, it's too soon to say which homebuilders might end up buying lots in Placer Ranch, Taylor said. Most likely, they'll be ones Taylor Builders has worked with before, he said.